Have you ever dreamt of building a secure financial future, one where your money works hard for you, growing steadily over time? The path to achieving that dream often leads through the world of investing. But with so many options and strategies, it can feel overwhelming to know where to start. This is where the “Essentials of Investments 11th Edition PDF” comes in – a comprehensive guide that demystifies the complex world of investing and provides a solid foundation for making informed financial decisions.

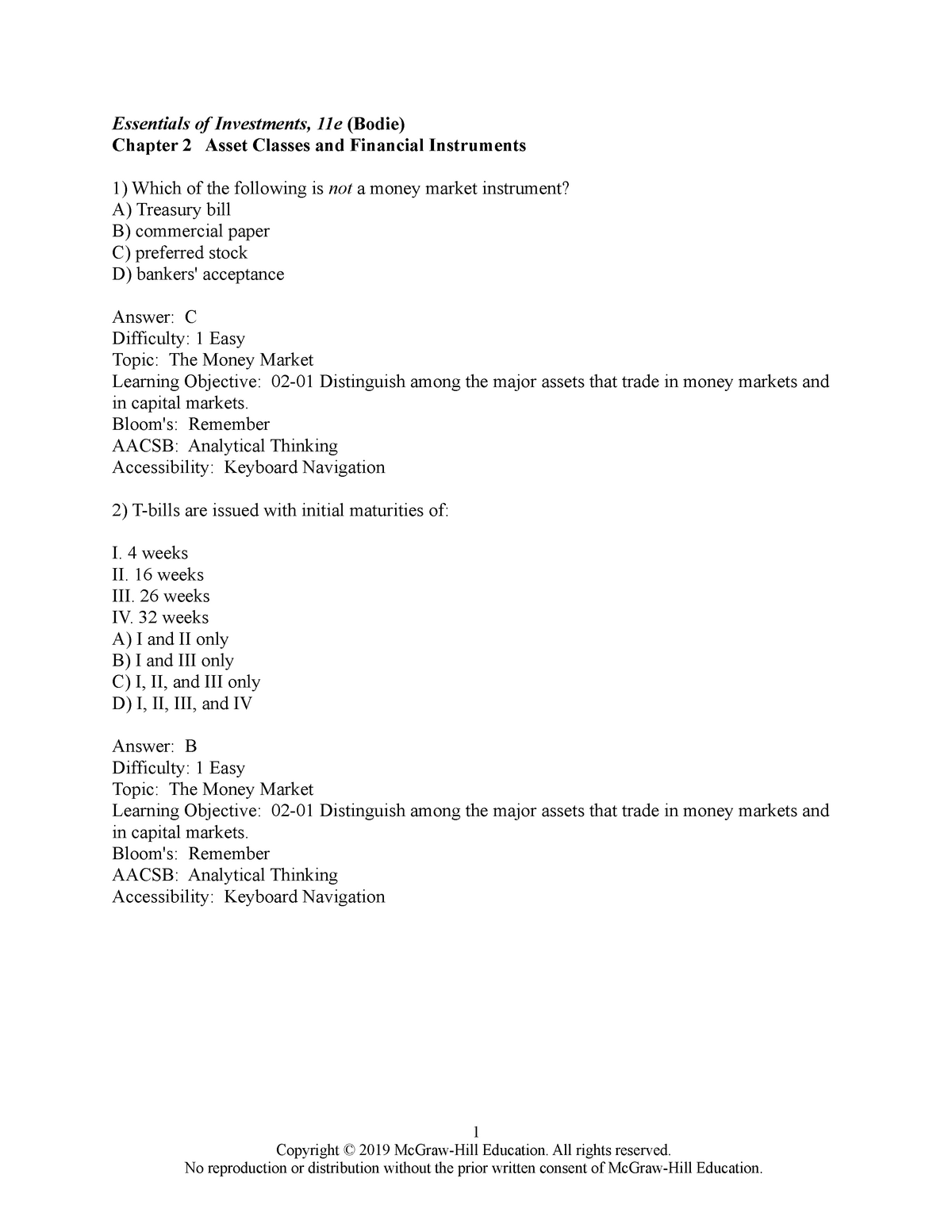

Image: www.studocu.com

This book isn’t just for finance professionals or seasoned investors – it’s designed for anyone who wants to understand the basics, learn effective strategies, and feel confident in their investment journey. Whether you’re a beginner just dipping your toes into the market, or someone looking to refine their existing investment approach, this resource holds invaluable knowledge that can help you navigate the path to financial security with clarity and purpose.

Unveiling the Essentials of Investing

The “Essentials of Investments 11th Edition PDF” is like a comprehensive roadmap for the world of investing. It breaks down complex financial concepts into easily digestible pieces, offering a clear understanding of:

- The Fundamentals: The book starts with an overview of financial markets, explaining how they function, the different types of securities available, and the role of intermediaries like brokers and exchanges. You’ll gain a clear grasp of core concepts like:

- Risk and return: Understanding how the potential for profit is inherently linked to the possibility of loss.

- Asset classes: Learn about the spectrum of investments, including stocks, bonds, real estate, commodities, and more.

- Diversification: Discover the importance of spreading your investments across different asset classes to mitigate risk.

- Investment Strategies: The book delves into practical strategies for building your portfolio, tailoring your approach to your individual goals, risk tolerance, and time horizon. You’ll learn about:

- Active vs. Passive Investing: Choosing between actively managing your portfolio or opting for a more hands-off approach.

- Top-Down and Bottom-Up Analysis: Understanding different methods for identifying investment opportunities.

- Fundamental and Technical Analysis: Learn to evaluate companies and make informed investment decisions.

- Portfolio Management: The “Essentials of Investments 11th Edition PDF” provides insights into managing your portfolio effectively, including:

- Asset Allocation: Distributing your investments across various asset classes to optimize risk and potential returns.

- Rebalancing: Adjusting your portfolio periodically to maintain your desired asset allocation.

- Performance Evaluation: Tracking your portfolio’s progress and making adjustments based on your goals.

- Special Topics: The book extends beyond basic concepts, offering insights into specific investment areas:

- Mutual Funds and Exchange-Traded Funds (ETFs): Learn about these popular investment vehicles and how they can help diversify your portfolio.

- Derivatives: Understanding options, futures, and other derivatives that can offer leverage and hedging opportunities.

- International Investing: Explore the opportunities and challenges of investing in global markets.

- Ethical investing: The book also touches upon the growing focus on ethical and sustainable investing, enabling you to align your investments with your values.

Expert Insights and Actionable Tips

The “Essentials of Investments 11th Edition PDF” offers insights from seasoned experts in the field of finance. These professionals guide you through the decision-making process, providing actionable tips to build a solid foundation for your investing journey.

- Start Early: You’ll learn how time is your greatest ally when it comes to investing. Early and consistent contributions can compound over time, allowing your investments to grow significantly.

- Invest Regularly: Don’t rely on lump-sum investments. Instead, adopt a disciplined approach of investing consistently, even small amounts, at regular intervals.

- Embrace a Long-Term Perspective: The market goes through fluctuations. Remember that your investment strategy is a marathon, not a sprint. Focus on long-term growth and resist the temptation to panic during market dips.

- Stay Informed: Knowledge is power. Continuously update your understanding of market trends, economic indicators, and company news to make informed investment decisions.

Image: indexcfd.com

Essentials Of Investments 11th Edition Pdf

Securing Your Financial Future, One Step at a Time

The “Essentials of Investments 11th Edition PDF” provides the starting point for your investment journey. By understanding the basics, exploring various strategies, and incorporating practical tips from experts, you equip yourself with the knowledge to make informed financial decisions. Remember, investing is a journey – one that requires patience, discipline, and a commitment to continuous learning. As you gain experience and confidence, you can refine your approach, explore advanced strategies, and ultimately achieve your financial goals.

This book is not just a collection of facts and figures; it’s an empowering resource that unlocks the potential for a brighter financial future. Start your journey today, and watch your efforts translate into tangible growth and security. The path to financial freedom starts with knowledge, and the “Essentials of Investments 11th Edition PDF” is the perfect guide to get you off to a strong start.