The journey to financial independence is often paved with a labyrinth of complex concepts and intricate financial strategies. While numerous approaches exist, many financial gurus, inspired by the teachings of Robert Kiyosaki’s “Rich Dad Poor Dad,” advocate for the power of a well-structured balance sheet as a crucial cornerstone of wealth building. For years, I’ve been fascinated by the concept of a balance sheet, and I was particularly drawn to the approach outlined in “Rich Dad Poor Dad.” This book opened my eyes to the importance of assets versus liabilities and how a carefully managed balance sheet can be a powerful tool on the path to wealth. But it wasn’t until I started using an Excel spreadsheet to track my finances that I truly embraced the practicality and effectiveness of this method.

Image: haseebjella.blogspot.com

As I began to track my assets and liabilities using an Excel spreadsheet, I realized how much clarity it brought to my financial situation. It wasn’t just about numbers on a page; it was about understanding where my money was going and how I could strategically allocate it to build wealth. I’m excited to share my insights and guide you on this journey to financial freedom using the “Rich Dad Poor Dad” principles and the power of an Excel balance sheet.

The Power of a Rich Dad Poor Dad Balance Sheet Excel: A Practical Guide

The “Rich Dad Poor Dad” balance sheet is not just a simple accounting tool; it’s a powerful visual representation of your financial health and a roadmap to achieving financial independence. It serves as a tangible guide that helps you visualize your financial goals and work towards them strategically.

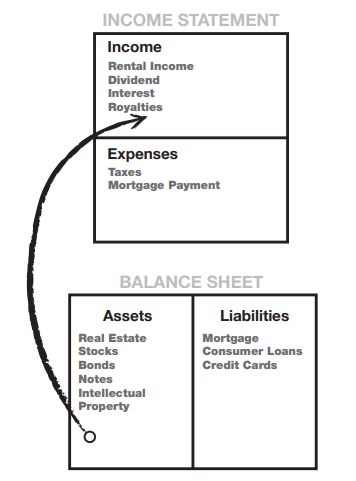

One of the core principles of “Rich Dad Poor Dad” is the difference between assets and liabilities. An asset is something that puts money in your pocket, while a liability takes money out of your pocket. Kiyosaki emphasizes that the rich focus on acquiring assets, while the poor and middle class accumulate liabilities. This concept is central to the “Rich Dad Poor Dad” balance sheet, which helps you classify your belongings and understand their impact on your financial well-being.

Understanding the Rich Dad Poor Dad Balance Sheet: Key Elements

The “Rich Dad Poor Dad” balance sheet is based on a simple equation: Assets = Liabilities + Net Worth.

Let’s breakdown these components:

- Assets: These are items that generate income or appreciate in value over time. Some examples include:

- Real estate investments

- Stocks and bonds

- Businesses that generate profit

- Intellectual property

- Liabilities: These are obligations that require you to make payments. Some common liabilities include:

- Mortgages and loans

- Credit card debt

- Student loans

- Net Worth: This represents your overall financial health. It is calculated by subtracting your liabilities from your assets. A positive net worth indicates you have more assets than liabilities, while a negative net worth reflects the opposite.

Building Your Rich Dad Poor Dad Balance Sheet Excel

Creating your “Rich Dad Poor Dad” balance sheet in Excel is relatively straightforward. Here’s a step-by-step guide:

- Create Three Columns: Label the first column “Assets,” the second column “Liabilities,” and the third column “Net Worth.”

- List Your Assets: In the asset column, list all your assets and their current market value.

- Investments: Include investments like stocks, bonds, mutual funds, and real estate.

- Businesses: If you own a business, list its value based on its current earnings potential.

- Other Assets: This could include things like valuable collectibles, vehicles, and even tangible assets from your business.

- List Your Liabilities: In the liabilities column, list all your debts and their outstanding balances.

- Mortgages: List the balance on your home or any other properties you own.

- Loans: List all personal or business loans, including the remaining balance.

- Credit Card Debt: List the outstanding balance on all your credit cards.

- Calculate Net Worth: In the Net Worth column, subtract the total liabilities from the total assets.

Image: www.richdad.com

Analyzing Your Rich Dad Poor Dad Balance Sheet Excel

The beauty of a balance sheet is its ability to reveal valuable insights about your financial health. By regularly reviewing your balance sheet, you can:

- Identify Financial Strengths: Recognize your strong asset positions and areas where your net worth is growing.

- Identify Financial Weaknesses: Pinpoint liabilities that are dragging down your net worth and require attention.

- Track Progress: Monitor your net worth over time to see how your financial decisions are impacting your wealth.

- Motivate Action: The balance sheet acts as a powerful motivator to make strategic financial decisions that increase your assets and reduce your liabilities.

Tips and Expert Advice

Using a “Rich Dad Poor Dad” balance sheet Excel can truly transform your financial landscape, but there are a few crucial tips that can make the process even more effective:

- Be Realistic: When assessing your assets, don’t overestimate their value. Use market values or reasonable estimates based on potential income generation.

- Be Consistent: Make updating your balance sheet a regular habit. Review it at least monthly to track your progress and make adjustments as needed.

- Set Realistic Goals: While a balance sheet helps you visualize your financial journey, it’s essential to set realistic financial goals. Focus on incremental improvement and celebrate your progress along the way.

Frequently Asked Questions about Rich Dad Poor Dad Balance Sheet Excel

Q: What is the best way to estimate the value of my assets?

A: For assets like stocks and bonds, you can use their current market price. For real estate, you can consult recent comparable sales in your area or get a professional appraisal. For businesses, consider current earnings and potential growth.

Q: What if I have negative net worth? Should I be concerned?

A: A negative net worth is common for many people, especially those starting their financial journey. The important thing is to actively focus on strategies to increase assets and reduce liabilities to improve your situation.

Q: How often should I update my balance sheet?

A: Ideally, update your balance sheet at least monthly. This allows you to track your progress and make adjustments as needed. You can also update it quarterly or semi-annually, depending on your preference and financial situation.

Rich Dad Poor Dad Balance Sheet Excel

Conclusion

The “Rich Dad Poor Dad” balance sheet Excel is a powerful tool that can empower you to take control of your finances. By actively tracking your assets and liabilities, you can gain invaluable insights into your financial health and work towards your financial freedom goals. Embracing this approach can be the starting point for building a brighter financial future.

Are you ready to start building your own “Rich Dad Poor Dad” balance sheet Excel and take control of your financial future?