Imagine you’re a small business owner in the UK, ready to export your handcrafted goods to a customer in Germany. You need a reliable and secure way to ensure payment for your products. Enter the international bill of exchange, a powerful financial instrument that can bridge international transactions and provide peace of mind for both seller and buyer.

Image: behnam-mahmoodzadegan-trading-academy.blogspot.com

This guide will walk you through the process of creating an international bill of exchange, shedding light on its advantages, and providing expert advice to maximize your financial security in global trade.

Understanding the Essence of an International Bill of Exchange

What is an International Bill of Exchange?

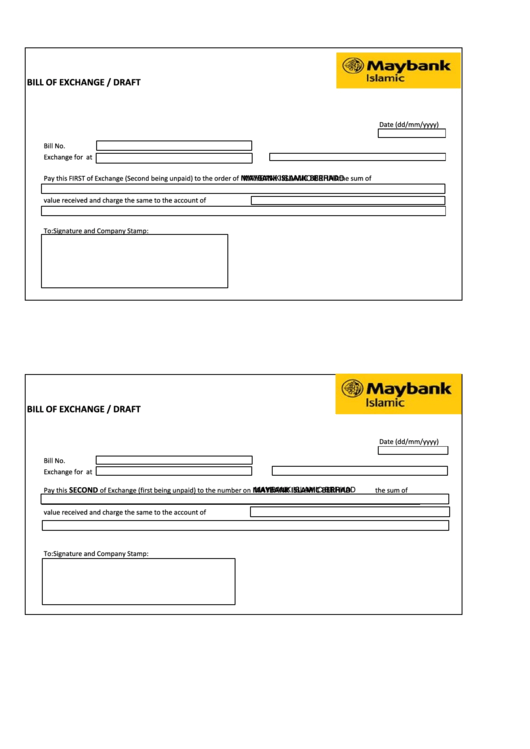

An international bill of exchange, often referred to as a “draft,” is a written order instructing a bank to pay a specific sum of money to a designated recipient at a future date. It acts as a promise of payment, allowing exporters to receive funds before the goods are delivered, while granting importers extended credit terms.

Think of it as a sort of promissory note for international transactions. The bill of exchange details the amount due, payment date, and the parties involved, providing a clear and documented commitment to payment.

Key Players in the International Bill of Exchange Process:

To grasp the mechanics of international bill of exchange, it’s essential to understand the roles of the key players:

- Drawer: The exporter (seller) who issues the bill of exchange, instructing the drawee bank to pay.

- Drawee: The importer’s bank, which is obligated to honor the bill of exchange upon presentation.

- Payee: The exporter (seller) who receives payment upon the drawee bank’s acceptance of the bill.

- Acceptor: The drawee bank that agrees to pay the bill of exchange on the maturity date.

Image: www.vrogue.co

Types of International Bills of Exchange:

There are two primary types of international bills of exchange:

1. Sight Drafts:

A sight draft requires immediate payment upon presentation to the drawee bank. This offers the exporter immediate access to funds but might not be suitable for all importers who prefer deferred payment terms.

2. Time Drafts:

A time draft specifies a future date for payment, allowing the importer a grace period to settle the bill. This option provides more flexibility to importers but introduces a higher risk for exporters, as they have to wait for payment.

Navigating the Creation Process:

Creating an international bill of exchange is a meticulous process requiring thoroughness and precision. Follow these steps to ensure a smooth transaction:

1. Determine the Bill’s Terms:

This involves specifying the following:

- Amount: The precise amount of money to be paid.

- Payment Due Date: The date on which the drawee bank must pay the bill.

- Currency: The currency in which the bill of exchange is denominated.

- Beneficiary: The payee who receives payment (typically the exporter).

- Drawee Bank: The importer’s bank responsible for payment.

2. Draft the Bill:

Employ a standardized format for clarity and accuracy. Ensure all information is accurate and consistent with the terms of the agreement. The International Chamber of Commerce (ICC) provides standard templates that can be adopted.

3. Send the Bill:

You can physically send the bill of exchange to the importer or their bank through courier service. You can also choose to transmit it electronically through secure messaging platforms or secure data networks.

Tips and Expert Advice for Successful Utilization:

Here are some tips to maximize the effectiveness of your international bill of exchange:

- Secure Acceptance: Request swift acceptance from the drawee bank to ensure payment is guaranteed.

- Document Thoroughly: Ensure that your contract clearly details the terms of the transaction, including the payment method, delivery conditions, and any agreed-upon grace periods.

- Utilize a reputable bank: Choose a bank with a strong international reputation and experience handling bills of exchange to minimize risks.

While bills of exchange offer financial security, don’t underestimate the importance of due diligence. Thoroughly investigate your buyers through credit checks and ensure a solid understanding of the relevant foreign laws and regulations that govern international trade.

Frequently Asked Questions (FAQs):

Q: What are the advantages of using an international bill of exchange?

A: International bills of exchange offer numerous advantages, including:

- Secure Payment: A bill of exchange provides a written promise of payment, reducing the risk of non-payment for exporters.

- Improved Cash Flow: Exporters can receive payment before delivering the goods, allowing for better cash flow management.

- Flexible Payment Terms: Time drafts offer importers flexibility to manage their cash flow and pay at a convenient date.

- Reduced Risk: The bill of exchange acts as a transferable document, allowing for easier collections and transfer of payments.

Q: What are the potential risks associated with using an international bill of exchange?

A: While offering significant advantages, using bills of exchange also comes with potential risks:

- Default Risk: There’s a risk that the drawee bank may not be able to honor the bill of exchange if the importer defaults on payment.

- Fraud Risk: There could be a risk of forged or fraudulent documents, so thorough verification is vital.

- Disputes: Disputes may arise between the parties if there is disagreement regarding the terms of the bill or the underlying transaction.

Q: How can I further manage the risks associated with bills of exchange?

A: To mitigate the risks, consider these strategies:

- Utilize Export Credit Insurance: Protect your business from non-payment by obtaining export credit insurance from insurance providers.

- Conduct Due Diligence: Thoroughly research potential buyers, check their creditworthiness, and ensure they have a reliable financial standing.

- Secure Collateral: Request collateral or guarantees from the importer or their bank as additional security to back up the bill of exchange.

How To Create An International Bill Of Exchange

Conclusion:

Navigating the complexities of international trade requires astute financial planning. An international bill of exchange can serve as a valuable tool for securing payment and facilitating smooth transactions. By adhering to the guidelines and expert advice outlined in this guide, you can leverage this powerful instrument to foster trust and confidence in your global business ventures.

Are you interested in learning more about specific aspects of international bills of exchange or have any specific questions about their application? Please don’t hesitate to engage in the comments section below.