Have you ever felt like your past is holding you back? Maybe you have a mountain of debt or an unfortunate legal history that’s preventing you from reaching your full potential. Many people find themselves in this situation, and the thought of a clean slate can be incredibly appealing. This is where the concept of a CPN (Credit Privacy Number) comes in. But before we dive into the details, it’s crucial to understand that obtaining a CPN “for free” is a tricky proposition. While there might be some free resources available, they are often limited and may not offer the complete solution you seek.

Image: superiortradelines.com

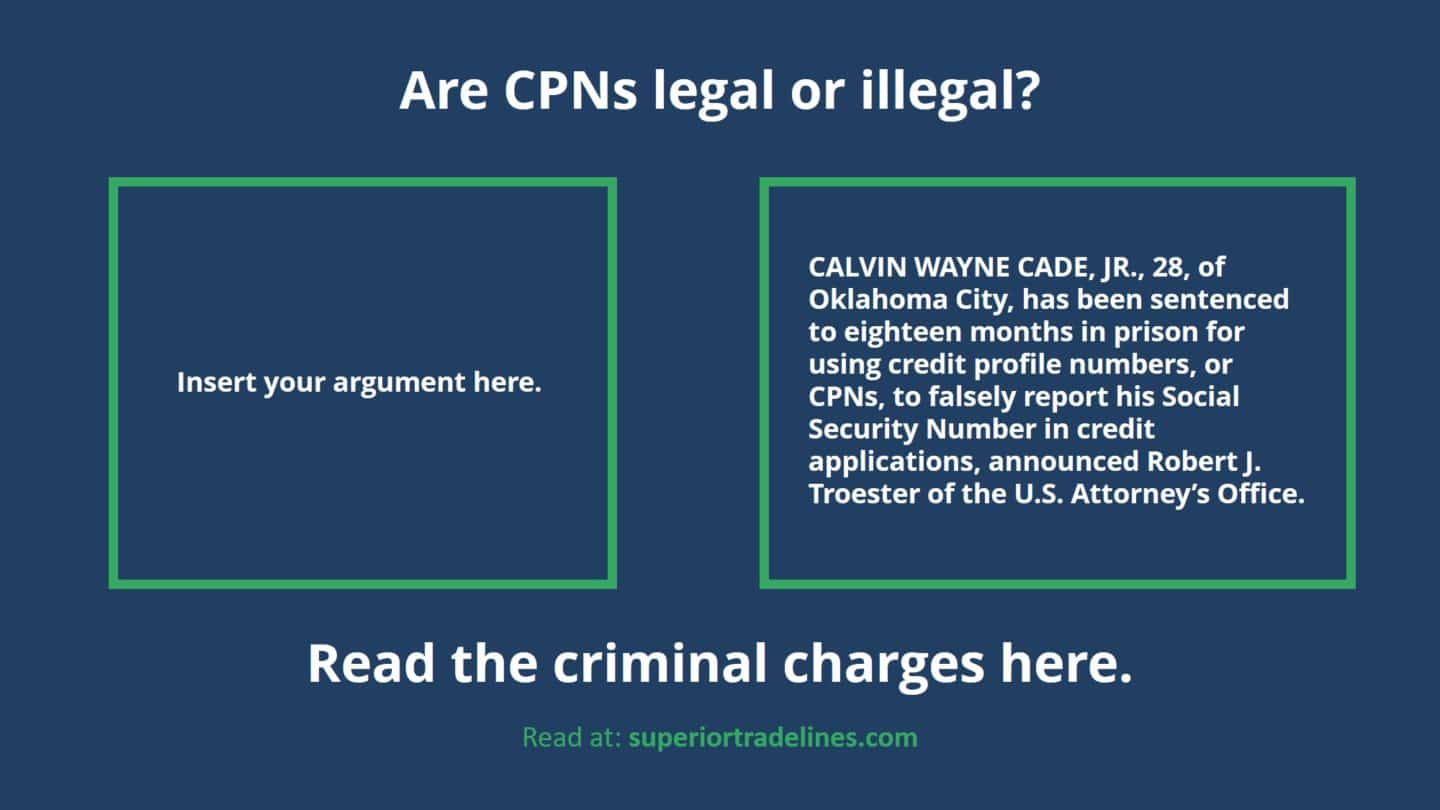

A CPN, also known as a Credit Privacy Number, is a nine-digit number that some companies offer as an alternative to your Social Security Number (SSN) for credit reporting purposes. These companies claim their CPNs help you create financial separation between your SSN and your credit history, potentially shielding you from negative financial associations. However, the legality and effectiveness of CPNs are highly debated, and many experts warn against relying on them for debt relief or credit repair. It’s also worth noting that the government does not recognize CPNs as a legitimate alternative to an SSN for purposes like credit reporting or tax filing.

Understanding the CPN Landscape

The use of CPNs has become increasingly popular in recent years, primarily due to its purported ability to “erase” past credit mistakes or shield individuals from financial obligations associated with their SSNs. However, it’s crucial to approach CPNs with a healthy dose of skepticism. Here’s why:

The Legal Gray Area

There’s a significant lack of legal clarity surrounding CPNs. While some argue that they can be used for credit reporting, the major credit bureaus (Experian, Equifax, and TransUnion) do not accept them as replacements for SSNs. This lack of acceptance can lead to further complications with credit applications and financial transactions. Moreover, the Internal Revenue Service (IRS) does not recognize CPNs, making them unsuitable for tax purposes.

The Risk of Scams

The allure of a “fresh start” has made CPNs a target for fraudulent companies. Many unscrupulous sellers promise miraculous debt relief or credit repair through CPNs, but their services often turn out to be scams. These scams can result in significant financial losses, identity theft, and even legal repercussions.

Image: www.scribd.com

The Financial Reality

The vast majority of legitimate credit reporting services require your SSN. This means that even if you obtain a CPN, you may still need to rely on your SSN for opening credit accounts or securing loans. Therefore, a CPN likely won’t be a complete solution for individuals seeking financial freedom from past mistakes.

Free Resources for “Cleaning Up” Your Financial Records

While acquiring a CPN for free is highly unlikely, there are reputable resources available to help you manage your finances and potentially improve your credit history. These resources often focus on education and empowerment, allowing you to take control of your financial future without resorting to potentially harmful shortcuts:

Consumer Credit Counseling Agencies (CCCAs)

These non-profit organizations provide free or low-cost credit counseling and financial education services. CCCAs can assist you with budgeting, debt management, and credit counseling. Look for CCCAs accredited by the National Foundation for Credit Counseling (NFCC) to ensure their credibility.

Credit Reporting Agencies

The major credit reporting bureaus (Experian, Equifax, and TransUnion) offer free access to your credit reports annually through AnnualCreditReport.com. Regularly checking your credit report can help you identify errors or potential fraud, allowing you to take steps to rectify the situation. Additionally, these agencies often provide financial education resources on their websites.

Government Resources

The Federal Trade Commission (FTC) offers a wealth of free resources on consumer protection, including information on identity theft, credit reporting, and debt management. The FTC’s website provides practical tips and tools for navigating the financial landscape responsibly.

Alternative Strategies for Financial Recovery

Instead of seeking a quick fix through a CPN, consider taking a more proactive and sustainable approach to your financial well-being. Here are some strategies for improving your credit score and managing your finances effectively:

Develop a Budget

Create a realistic budget that tracks your income and expenses. Identifying where your money is going can help you make informed financial decisions and eliminate unnecessary spending. Budgeting tools and apps can make this process easier and more efficient.

Pay Your Bills on Time

Your payment history is a crucial factor in determining your credit score. Make sure to pay all your bills on time, and consider setting up automatic payments to minimize the risk of late fees or missed payments.

Reduce Your Debt

Work towards reducing your existing debt by following a structured plan. Consider debt consolidation, balance transfers, or negotiating lower interest rates with your creditors. Focus on paying down high-interest debt first, as it can quickly escalate your overall financial burden.

Build a Positive Credit History

If you’ve struggled with your credit score in the past, focus on building a positive credit history by opening a secured credit card or becoming an authorized user on a trusted person’s account. These actions demonstrate responsible credit use and can improve your credit score over time.

How To Get A Cpn For Free

The Bottom Line: Focus on Financial Literacy

Instead of chasing the elusive “free CPN,” invest your time and energy in learning about sound financial practices. Educate yourself on how credit works, how to manage your debt, and how to build a strong credit history. This approach will not only prevent you from falling victim to scams but also set you on the path to long-term financial security. Remember, true financial freedom comes from informed decision-making and responsible financial behavior, not from quick fixes or questionable shortcuts.

This guide has outlined some of the complexities surrounding CPNs and provided potential alternatives for managing your credit and finances. Remember, it’s crucial to consult with qualified financial professionals, such as credit counselors or attorneys, before making any significant financial decisions. Take control of your financial future, and make informed choices that will benefit your long-term well-being.