The AP Macroeconomics course takes students on a journey through the complexities of the global economy. Unit 4, focusing on “Monetary Policy and the Financial System,” is a crucial chapter in this journey. It’s like learning the controls of a sophisticated machine—understanding how monetary policy influences the economy and the critical role the financial system plays in this process. Just like a skilled pilot needs to understand the instruments of their plane, mastering these concepts is essential to navigating the economic landscape.

Image: studylib.net

As a student preparing for the AP Macro exam, I remember the apprehension I felt during this unit. It felt like a whole new set of concepts were being thrown at me—from the Fed’s tools to the intricacies of the money supply. However, I realized that by breaking down these seemingly complex topics into smaller, understandable chunks, the whole picture began to make sense. This article will guide you through the key concepts of Unit 4, providing you with a solid foundation to confidently navigate the practice tests and ultimately ace your AP Macro exam.

Understanding Monetary Policy and its Impact

Monetary policy, essentially, is the government’s approach to managing the money supply and credit conditions to achieve macroeconomic goals. Think of it like a conductor leading an orchestra, adjusting the volume and tempo of economic activity. The Federal Reserve, often referred to as “the Fed,” plays the role of this economic conductor. This powerful institution has a significant influence on the economy’s performance, influencing factors such as interest rates, inflation, and overall economic growth.

The Fed uses a variety of tools to achieve its policy objectives, including:

- Open Market Operations: This involves buying or selling U.S. Treasury bonds in the open market. Buying bonds injects money into the economy, lowering interest rates and stimulating spending, while selling bonds removes money, raising interest rates and dampening spending.

- The Federal Funds Rate: This is the target interest rate that banks charge each other for overnight loans. By adjusting this rate, the Fed influences the overall cost of borrowing in the economy.

- The Discount Rate: This is the interest rate at which commercial banks can borrow directly from the Fed. By adjusting this rate, the Fed can signal its intentions to the financial market and influence borrowing costs.

- Reserve Requirements: These are regulations that dictate the percentage of deposits that banks must hold in reserve. Changing these requirements can affect the amount of money banks have available to lend, thus influencing the overall money supply.

The Role of the Financial System in the Economy

The financial system, not just an intricate web of institutions, is a vital part of the economic engine. It acts as a crucial intermediary, facilitating the flow of funds between savers and borrowers. Banks, for example, play a key role in this process, taking deposits from savers and lending them to those who seek financing for projects or investments. This intermediation process is essential for economic growth, as it channels funds to productive uses and fosters innovation.

The financial system also plays a role in mitigating risk. Through activities like diversification and insurance, investors can manage the uncertainties inherent in economic activity. This risk management function is essential for promoting stability in the financial system and the broader economy. We explore risk management and different types of risks investors face in this unit.

Here are some key components of the financial system:

- Commercial banks: These institutions play a central role in the financial system, accepting deposits and providing loans for businesses and individuals.

- Investment banks: These institutions focus on providing services to businesses, such as underwriting securities and providing financial advice.

- Financial markets: These are platforms where securities, such as stocks and bonds, are bought and sold. They provide a mechanism for channeling funds from those who have them to those who need them.

- Financial institutions: This broader category includes a wide range of organizations, such as insurance companies, mutual funds, and pension funds, that play various roles in the financial system.

The Importance of Financial Markets in the Economy

Financial markets are crucial to the efficient allocation of resources in the economy. They provide a platform for businesses to raise capital for investment, for individuals to manage their savings, and for governments to finance their operations. The key types of financial markets include:

- Money Market: This facilitates short-term borrowing and lending, mainly for periods of a year or less. Instruments like Treasury bills and commercial paper are traded in this market.

- Capital Market: This deals with longer-term financing, typically for periods exceeding a year. Securities such as stocks and bonds are bought and sold in this market.

- Foreign Exchange Market: This allows for the exchange of currencies, facilitating international trade and investment.

- Derivatives Markets: These offer financial instruments, such as futures and options, which derive their value from underlying assets. These instruments can be used for hedging risk or speculation.

Image: www.teacherspayteachers.com

Key Concepts to Master for Unit 4

Here are some key concepts you should focus on as you prepare for your AP Macroeconomics Unit 4 practice test and exam:

- The Money Supply: Understand the different measures of the money supply (M1, M2, etc.), how they differ, and how they are influenced by the Fed’s actions.

- Interest Rates: Know how the Fed sets interest rate targets, and how these targets influence borrowing, lending, and overall economic activity.

- Inflation: This is a persistent increase in the general price level. Understand how the Fed can use monetary policy to control inflation and the potential risks associated with both high and low inflation.

- The Phillips Curve: This shows the short-run relationship between inflation and unemployment. Understand its implications for policymakers balancing inflation and unemployment targets.

- The Role of Banks: Know the key functions of commercial banks, including deposit-taking, loan creation, and their role in the money supply.

- Financial Regulations: Understand the purpose of financial regulation, including the different types of laws and regulations that banks and other financial institutions must adhere to.

- The Great Recession: Learn the causes and consequences of the 2008 financial crisis, and how it demonstrates the importance of a robust financial system and appropriate regulation.

Strategies for Success on Unit 4 Practice Tests

Here are some tips to help you ace your AP Macroeconomics Unit 4 practice tests:

- Focus on Understanding the “Whys”: Don’t just memorize definitions; focus on understanding “why” things happen. For example, why does the Fed use open market operations to influence interest rates?

- Use Visual Aids and Diagrams: AP Macroeconomics often involves intricate relationships between economic variables. Use charts, graphs, and diagrams to visualize these concepts and make them easier to understand.

- Practice with Past Tests and Questions: Utilize past practice tests and questions that align with the AP Macroeconomics curriculum. This helps you get familiar with the format, question types, and common themes.

- Engage with Current Events: Pay attention to current economic events in the news. How do these events relate to the concepts you’re learning? This helps you apply theory to real-world situations.

FAQ: Addressing Common Questions

Q: What is the difference between monetary policy and fiscal policy?

A: Monetary policy refers to actions taken by the central bank (like the Fed) to manage the money supply and credit conditions. Fiscal policy, on the other hand, involves government spending and tax policies to influence the economy.

Q: What is the target inflation rate?

A: The Federal Reserve’s target inflation rate is around 2%. This is considered “healthy” as it allows businesses to plan for price increases and keeps the economy from stagnating.

Q: What is the role of the Treasury Department?

A: The Treasury Department is responsible for managing government finances. They issue Treasury bonds and regulate the printing of currency. While they are not directly involved in monetary policy, their actions can impact the Fed’s ability to achieve its goals.

Q: Why is the financial system so important?

A: The financial system is crucial for the smooth functioning of a modern economy. Without a reliable system for savings, lending, and risk management, it would be difficult to allocate resources, stimulate investment, and promote economic growth.

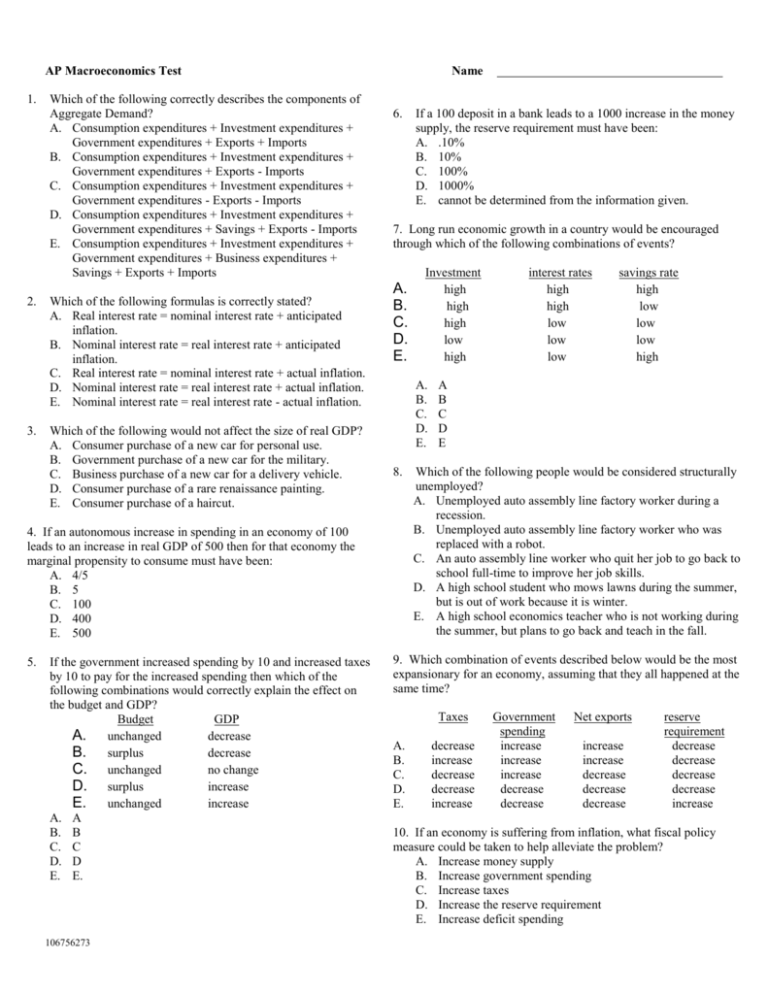

Ap Macro Unit 4 Practice Test

Concluding Thoughts: Mastering Monetary Policy and the Financial System

Mastering AP Macroeconomics Unit 4 requires a deep understanding of monetary policy, the financial system, and their intricate connections. By focusing on the “whys” behind these concepts, leveraging visual aids, and practicing with past tests and questions, you can confidently navigate practice tests and ultimately achieve success on the AP Macro exam.

Are you ready to conquer your AP Macro practice tests and gain a strong grasp of monetary policy and the financial system? Share your thoughts and questions in the comments below. Let’s discuss and learn together!