Imagine this: you’ve got your eye on that sleek, new SUV, the one that’s been calling your name for months. But the price tag? It’s a big one. You’re not sure you can afford a traditional loan, and you’re dreading the hassle of a lengthy financing process. What if there was a way to drive your dream car today, pay it off gradually, and ultimately own it outright? That’s where a vehicle lease to own agreement comes in.

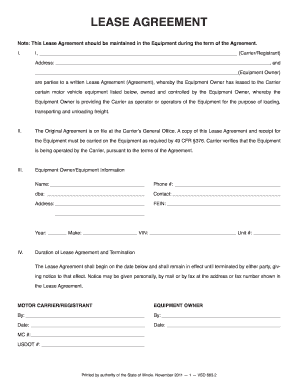

Image: www.dochub.com

A vehicle lease to own agreement is a financial arrangement that allows you to lease a vehicle with the option to purchase it at the end of the lease term. It’s like a blend of leasing and financing, offering a unique path to car ownership. This guide will dive deep into the world of vehicle lease to own agreements, providing you with the knowledge and tools to navigate this financial landscape with confidence.

Understanding the Mechanics of a Vehicle Lease to Own Agreement

A lease to own agreement is a carefully structured contract between you and a lender or dealership. It outlines the terms of your lease, which include the monthly payment, lease duration, and the vehicle’s eventual purchase price. Here’s a breakdown of the key elements:

1. The Initial Lease:

- You’ll agree to a set lease term, usually spanning several years.

- During this period, you’ll make monthly payments, similar to a traditional lease. However, a portion of your payments goes towards the vehicle’s purchase price.

2. The “Rent-to-Own” Option:

- At the end of the lease term, you have the option to purchase the vehicle for a predetermined price.

- This purchase price could be a significantly reduced amount compared to the original vehicle’s price tag.

- Many lease to own agreements include an accelerated ownership option, allowing you to buy the car before the lease is up for a reduced price.

3. The Lease to Own Advantage:

- Lower Down Payment: You might encounter lower down payment requirements compared to traditional financing.

- Flexible Ownership: You gain the flexibility to decide if you want to purchase the vehicle at the end of the lease.

- Built-in Equity: Each payment contributes to both the lease and the vehicle’s purchase price, building equity progressively.

The Fine Print: Key Considerations for Vehicle Lease to Own

While seemingly straightforward, lease to own agreements involve several essential details to consider before signing on the dotted line.

1. Lease Terms and Duration:

- Longer lease terms often translate to lower monthly payments, but they also lead to a higher total cost of ownership.

- Carefully assess the lease duration and weigh it against your financial goals and driving needs.

2. Purchase Option Price:

- The purchase price at the end of the lease is a crucial factor.

- Ensure you understand the agreed-upon price and its potential implications for your budget.

3. Interest Rates and Fees:

- Lease to own agreement often have higher interest rates than traditional financing.

- Additionally, you may encounter additional fees, such as maintenance fees, mileage penalties, and early termination charges.

4. Ownership Transfer Process:

- The process for transferring ownership at the end of the lease should be outlined clearly in your agreement.

- Make sure you understand all the steps and necessary documentation involved.

When Vehicle Lease to Own Makes Sense

For many, a vehicle lease to own agreement presents a compelling alternative to traditional financing. Here are some scenarios where it could be a good fit:

1. Limited Credit History: If you have a limited credit history or are working on rebuilding your credit, lease to own can provide a path to car ownership.

2. Desire for Reduced Monthly Payments: The lower upfront costs and potentially lower monthly payments can be attractive for people with limited budgets.

3. Testing the Waters: Considering you have the option to purchase the vehicle at the end of the lease, you can “test drive” ownership and see if the car fits your long-term needs.

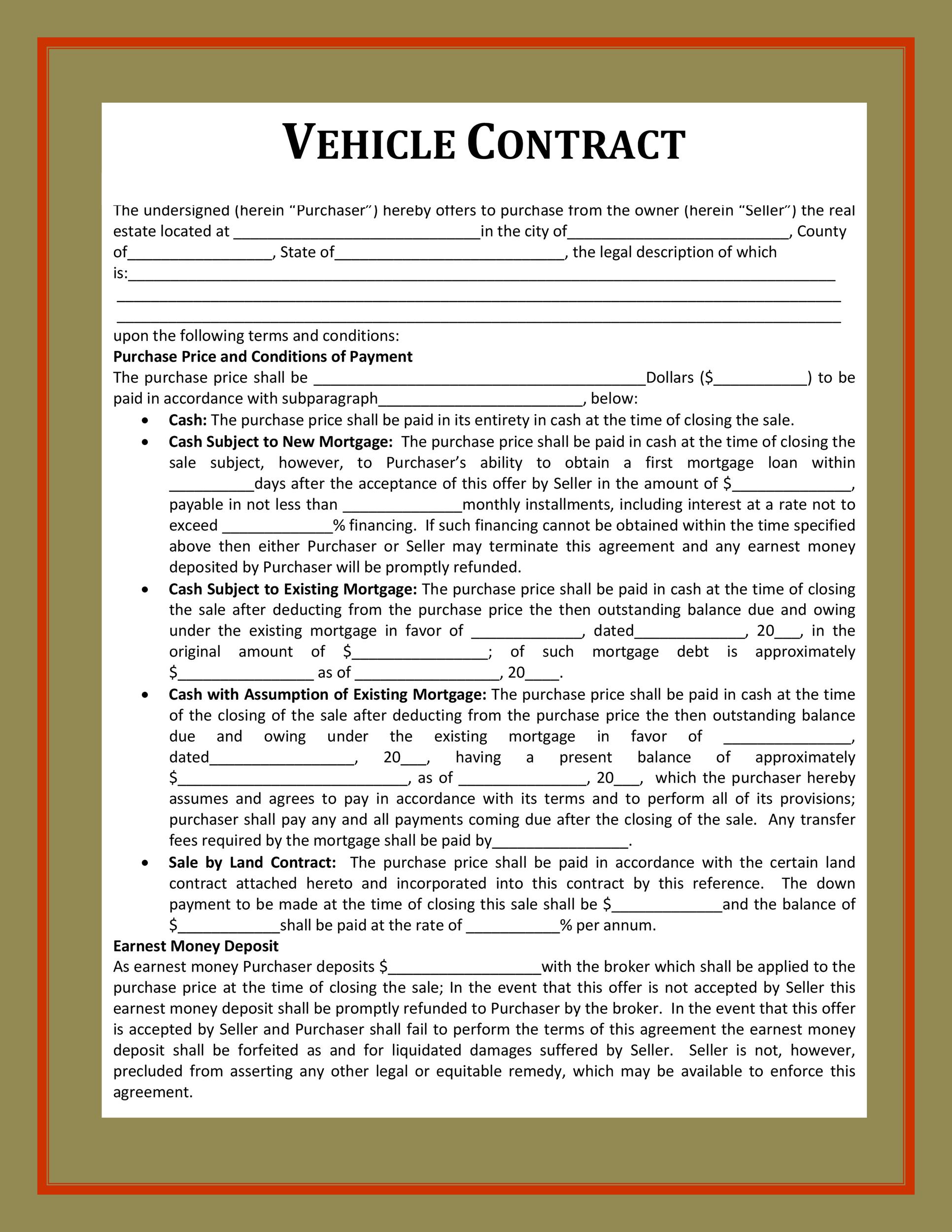

Image: doctemplates.us

Potential Challenges to Be Aware Of:

While there are benefits, it’s important to understand potential drawbacks of a lease to own agreement:

1. High Overall Costs: A lease to own agreement may result in higher total costs than traditional financing due to higher interest rates.

2. Potential for Penalties: Be prepared for penalties like mileage fees, early termination fees, or maintenance fees.

3. Limited Options for Early Termination: You might have limited flexibility to exit the lease early, which could lead to financial setbacks.

Finding the Right Vehicle Lease to Own Agreement

Navigating the world of lease to own contracts can be overwhelming. Here are some tips to navigate the process effectively:

- Shop Around: Compare terms from different lenders, dealerships, and lease to own companies to secure the most favorable deal.

- Read the Fine Print: Thoroughly review all terms and conditions in the agreement, seeking professional legal advice if needed.

- Be Realistic: Assess your budget and financial situation honestly, ensuring you can comfortably afford the monthly payments and the eventual purchase price.

Vehicle Lease To Own Agreement Template

Your Path to Vehicle Ownership

A vehicle lease to own agreement can be a practical path to car ownership, but only if you understand the terms and potential challenges. By conducting thorough research, asking informed questions, and carefully comparing options, you can make an informed decision that fits your financial goals and driving needs. Embrace the journey of vehicle ownership, and remember, driving away in your dream car is just the beginning.